Build a stronger, smarter financial life today.

From debt reduction to credit improvement, we guide you every step of the way.

Experience 40+ years of proven financial leadership.

Veteran-owned business providing expert advice, training, and financial oversight.

Learn, plan, and achieve financial success with confidence.

From college finances to your first home or car, we guide your journey.

The Financial Wisdom LLC - Our mission is to help individuals and families make smarter financial decisions with confidence.

Personal Financial Assessment

Evaluate your current financial situation, identify overpayments on major purchases, and receive a tailored improvement plan.

Financial Training, Coaching, Sessions

Hands-on sessions to help you avoid financial pitfalls, make smarter decisions, and strengthen your buying power.

Financial Guidance You Can Trust

Financial Wisdom, LLC is a Service-Connected Disabled Veteran Owned Business with over 40 years of experience in leadership, training, and customer service. Our mission is to help individuals and families make smarter financial decisions with confidence.

We provide personal financial assessments, debt management strategies, credit improvement, and coaching - all guided by the values of trust, integrity, and responsibility.

We Can Help You With

Provide lifestyle changes for yourself and family

Personal Financial Inventory Assessment (PFIA) training

Car, student, home advice and coaching strategies

Workshops: junk fees on car and home purchases

Provide protective warning for future financial decisions

Improve your credit score – increase your buying power

Advice on debt cancellation or elimination

Avoid misinformed financial pitfalls (good or bad decisions)

Evaluate your financial status

Hands-on assistance, coaching, advising, and negotiating

Acknowledge mistakes and create and execute a plan of correction

Measure the impact of inflation on your and others’ purchases

Learn how to Maximize your income and erase bad debt

Calculate your loan pay-off plan

Debt-to-Income ratio

Assessment Feedback Program

Determine if you are paying too much: car, home, and education

Importance of taking responsibility for unwise financial choices and bad decisions is key to success

We handle your entire HR Civil Rights Program, unbiased business occupational assessment review:

- How to build a diverse workforce

- We identify strengths, weaknesses and help develop solutions

- Assessment HR unequal promotion opportunities

- Work Civil Rights Discrimination Cases

- Conduct ADA facility inspections with reports

- Receive and process employee Request for Assistance

- Conduct unbiased inquiries and investigate Reprisal and Retaliation cases

- Identify all HR. Civil Rights related systemic problems

- Final Assessment Reports with recommendations/solutions and follow-ups.

- Development of an Organizational Civil Rights Oversight Program

- Training: New Employees, Annual or a Semi-Annual Human Resource Management Employee Workshop Training online or classroom

Trust is the foundation of great service

- A strong team of retired military leaders who continues to serve our great Country.

- A Global Human Resource Competency Company Disabled Veteran Small Business (DVSB) – Integrity Compliance HR, Human Resource Management, LLC

Features

- Trust

- Accuracy

- Confidentiality

- Expertise

- Experience

- Professional

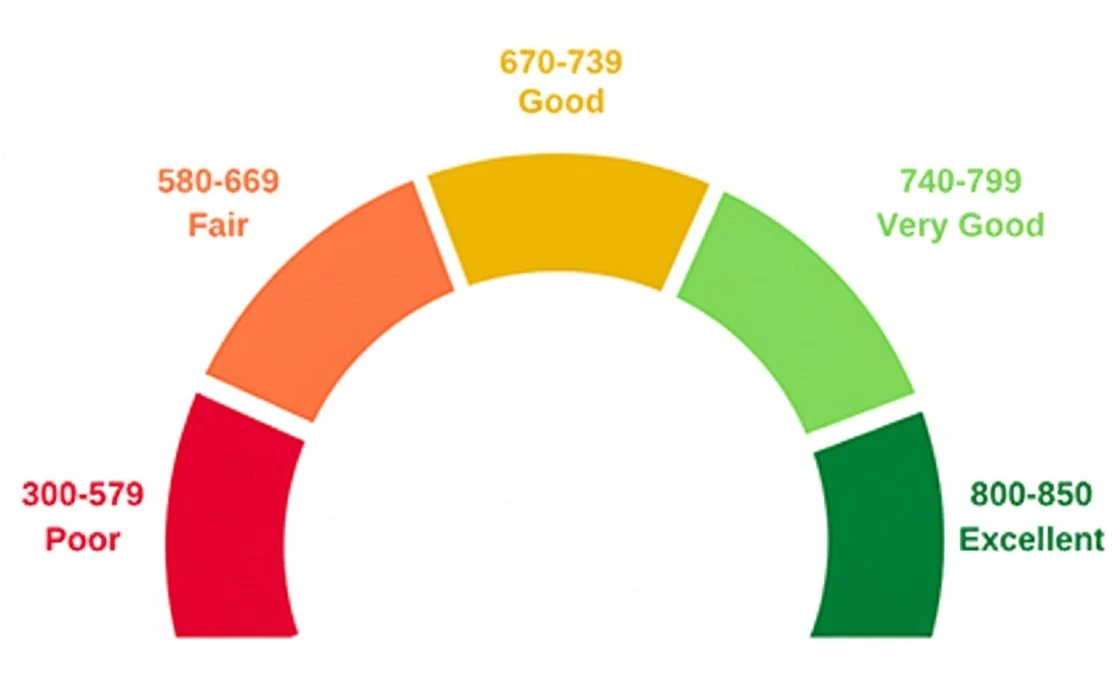

Credit Score Chart

Understand the credit score categories so you can make smarter financial choices for a healthier financial life.

Discover the keys to financial success, you must master the fundamental skills of money management, including budgeting, disciplined saving, and wise investing.

A key component is defining what financial success means to you, as this will guide your strategy.

Education, coach and mentored

- Invest in financial literacy: follow and trust your personal consultant, coach, mentor, advisor. Understanding personal finance gives you the confidence to manage your money wisely and effectively.

- Invest in yourself: Your biggest asset is your potential to earn more. Continue to upgrade your knowledge through education or training to increase your short and long-term money management plans.

- Consider professional guidance: If your finances are complex, working with a qualified financial advisor can provide personalized strategies and keep you on track toward your goals (car, home and education).

Manage your debt strategically

- Create a debt repayment plan: Prioritize paying off high-interest debts, like credit card balances, first. This is known as the debt avalanche method and can save you money on interest in the long run. The debt snowball method, where you pay off the smallest debts first, can also be used to build momentum.

- Avoid new debt: While paying down existing debt, freeze or hide your credit cards to avoid adding unnecessary purchases to your balance.

- Use credit wisely: Once out of high-interest debt, use credit cards responsibly by paying off the full balance each month. This builds your credit score and prevents costly interest charges.

Prioritize saving and investing

- Save for emergencies: Before investing, build an emergency fund covering at least three to six months of living expenses. This safety net prevents you from accumulating debt during unexpected setbacks like a job loss or medical bill.

- Pay yourself first: Treat your savings as a bill. Automate transfers to a savings or investment account right after you get paid. This makes saving a consistent habit.

- Invest wisely: Start investing early to take advantage of compound interest. Consider beginner-friendly options like low-cost index funds or Exchange-Traded Funds (ETFs) and contribute to tax-advantaged retirement accounts like a 401(k) or IRA.

- Diversify your portfolio: Reduce risk by spreading your investments across different assets (e.g., stocks, bonds, real estate) instead of putting all your money into one place.

Master your budget

- Track your income and expenses: For at least one month, track every dollar coming in and going out. Use a spreadsheet or a budgeting app to get a realistic picture of your finances.

- Differentiate needs vs. wants: Categorize your expenses. Needs are essential for living (e.g., housing, food, utilities), while wants are discretionary (e.g., dining out, subscriptions).

- Review and adjust regularly: A budget is not a one-time task. As your circumstances and priorities change, you will need to adjust your budget to stay on track.

Establish your financial goals

- Short-term goals (0–12 months): Examples include building an initial emergency fund or paying off a small credit card balance.

- Mid-term goals (1–5 years): This may involve saving for a down payment on a house, a new car, or your child’s education.

- Long-term goals (5+ years): Focus on retirement planning, building significant wealth, or achieving financial independence.

Some Questions & A.

What makes Financial Wisdom, LLC different from other financial services?

Unlike companies that focus on selling products, our mission is to guide and coach. We provide personalized financial assessments, training, and advice so you can make smarter decisions about cars, homes, education, and overall money management.

Can you help with specific goals, like paying off loans or improving credit?

Yes. We specialize in creating loan pay-off plans, improving credit scores, and helping you maximize your income while reducing debt. Our role is to equip you with tools and strategies to reach your personal financial milestones.

How does financial coaching work?

We start with an evaluation of your current financial situation, then provide customized feedback and strategies. Through one-on-one sessions, training, and hands-on support, we help you take clear steps toward your financial goals.

Example:

I had my 2019 Toyota for 2 years, current miles 96,000, loan 60 months interest rate 8%, monthly payment with insurance is around $700, 3 years for pay-off. I am paying about $1000 a year for repairs, routine maintenance and upkeep. Can Allan help me reduce this debt?

Do I need to have financial problems to benefit from your services?

Not at all. Our coaching is designed for anyone, students, families, or individuals, who want to better understand their finances, avoid mistakes, and plan for a stronger financial future.

If you have more questions Contact Us

From Stress to Success

Not only did he walk me through the process with clarity, but he also made sure every detail was handled smoothly, giving me peace of mind. Thanks to Finance Wisdom, I was able to drive away with confidence, knowing I had gotten the right deal on the right vehicle.

I highly recommend Financial Wisdom to anyone looking for a trustworthy partner when purchasing their next vehicle. Mr. Ladd delivered exceptional service, and I couldn’t be happier with the outcome.

Thank you.

Copyright Financial Wisdom, LLC - Designed By Mondollo - 2025